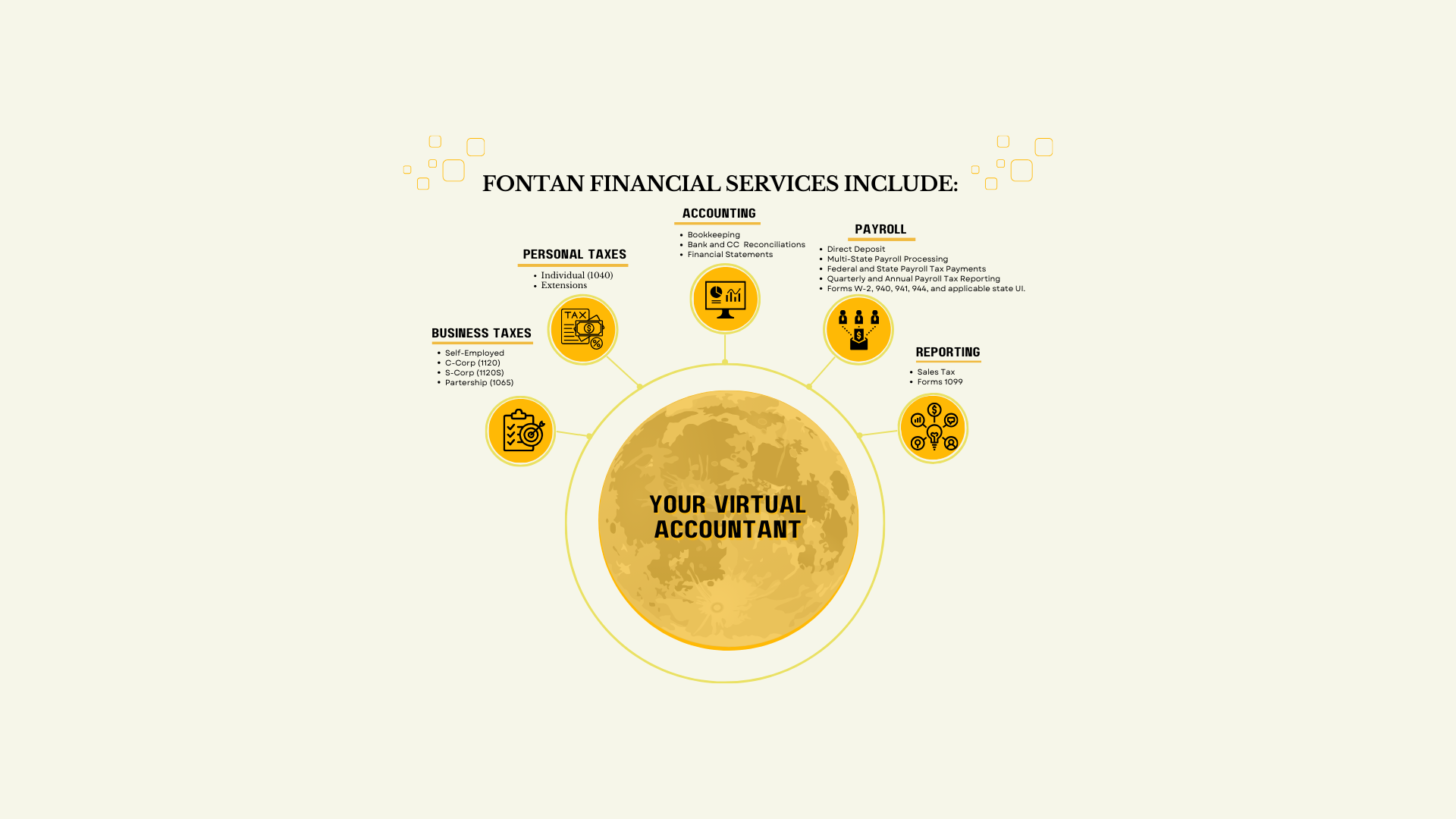

Quality Tax and Accounting Services - Reimagined

Virtual Tax, Bookkeeping, and Payroll Professionals, backed with the power of cloud-based solutions, provide the support to help businesses and individuals succeed.

How it Works for Businesses

Get started right away by contacting us for a free consultation to discuss your company’s unique needs. We will help you get setup with an accounting and/or payroll software system and will connect your company’s accounts. If you already have an accounting and /or payroll software system in place, we will help you to seamlessly transition the workload to our accounting experts.

We take care of the Setup

We take care of your books

Our job is to manage your books so you can manage your business. We make sure your bookkeeping and payroll processes are running like clockwork and off your plate. Our professional accounting experts will categorize your business transactions and reconcile your bank and CC accounts. Our payroll experts will process your payroll and will handle your payroll reporting requirements in accordance with applicable federal and state laws.

You can expect clear and consistent communication with financial reports being delivered monthly to your client portal. Access your company’s financial reports 24/7 and rest assured that access to your company’s financial records is only a few clicks away. Enjoy the peace of mind that comes from having a team of experts manage your back office on your behalf.

We keep you

Up-To-Date

Virtual Tax and Accounting Services:

Accounts Receivable (A/R)

A/R is an asset account that tracks the money due from customers for sales of product or services that your business offers. We help keep your cash flowing by managing your accounts receivable.

Bank & CC Account Reconciliation

The bank reconciliation ensures that all transactions that have gone through the business’ bank accounts have been carefully reviewed and categorized, thus reducing probabilities of errors in the data used to prepare financial reports. We help you avoid financial fraud and theft by reconciling your business bank and CC accounts on a monthly/quarterly basis.

Accounts Payable (A/P)

A/P is a liability account that tracks the money your business owes to vendors/suppliers and bills for goods and/or services. We help improve your cash flow by managing your accounts payable.

Bookkeeping Clean-Up / Catch-Up

Clean-up and Catch-up bookkeeping is the process of getting financial records up-to-date for previous periods that are currently behind schedule. Whether you need a few months or years, our expert accounting professionals will help get your books up-to-date and ready to file.

Financial Reporting

Financial reporting is a standard accounting practice that uses financial statements to disclose a company’s financial information and performance over a particular period. We provide you with financial reporting on a monthly basis to help you assess the financial health of your business.

Payroll

Payroll is the compensation a business must pay to its employees for a set period and on any given date. We help you manage your payroll process by calculating wages, withholding deductions and taxes. Also, by distributing payments directly to your employees and remitting all payroll tax payments to the applicable federal and state agencies and accurately filing all required payroll reports.

Sales and Use Tax

Sales tax is a consumption tax imposed by the government on the sale of goods and services. A conventional sales tax is levied at the point of sale, collected by the seller, and passed on to the applicable governing agency. We help you remain compliant with the governing agencies by remitting and filing your business’ sales tax according to the required frequency period and policy assigned.

Budgeting

A business budget is a financial roadmap for an upcoming period. A budget is a spending plan for your business based on your income and expenses for a period. It identifies your available capital, estimates your spending, and helps you predict revenue to meet your business goals. We help you develop and oversee the right type of budget for your business to meet its financial goals.

Training for QuickBooks and Setup

This solution is perfect for new business owners who prefer to work hands-on and who simply need the guidance and support of a trusted member of the QuickBooks ProAdvisor program at your convenience. We meet you at your level of understanding and will train you until you become a confident QuickBooks user.

Tax Planning

Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes legally possible. We help you by providing effective tax planning solutions so you don’t end up paying more taxes than necessary or not saving as much as you could.

Tax Preparation and Filing

A tax preparer is responsible for preparing and filing income tax returns on behalf of businesses and individuals. We help you remain compliant with the Internal Revenue Service and your local state agencies by accurately and timely preparing and filing your federal, state, and local tax returns.

Tax Representation

Tax Representation is a service in which a tax professional stands on behalf of a taxpayer (an individual or legal entity) . We are enrolled to practice before all levels of the IRS and can represent you in the event of an tax audit. We also assist with tax notice guidance and resolution.

We balance your books

You balance your business

Behind on taxes and bookkeeping?

DON’T STRESS - YOU ARE NOT ALONE

Our Virtual Accounting Experts take on the process of getting your books caught up while reconciling all your bank, credit card, and payroll accounts, giving you the confidence you need to submit your company’s financial reports to the bank and/or to get you ready to file back taxes.

Year-round tax support

With expert tax preparation, filing, and year-round tax advisory support, we’ll keep you tax-ready all year long.

We’ll also help you with your personal taxes too.